The Revival of Banca Monte dei Paschi di Siena: The Treasury Sell

The article's purpose is to outline the recent operative trend of Banca Monte dei Paschi di Siena, analyzing the reasons and implications for the recent Treasury Sale.

Monte dei Paschi di Siena’s Context

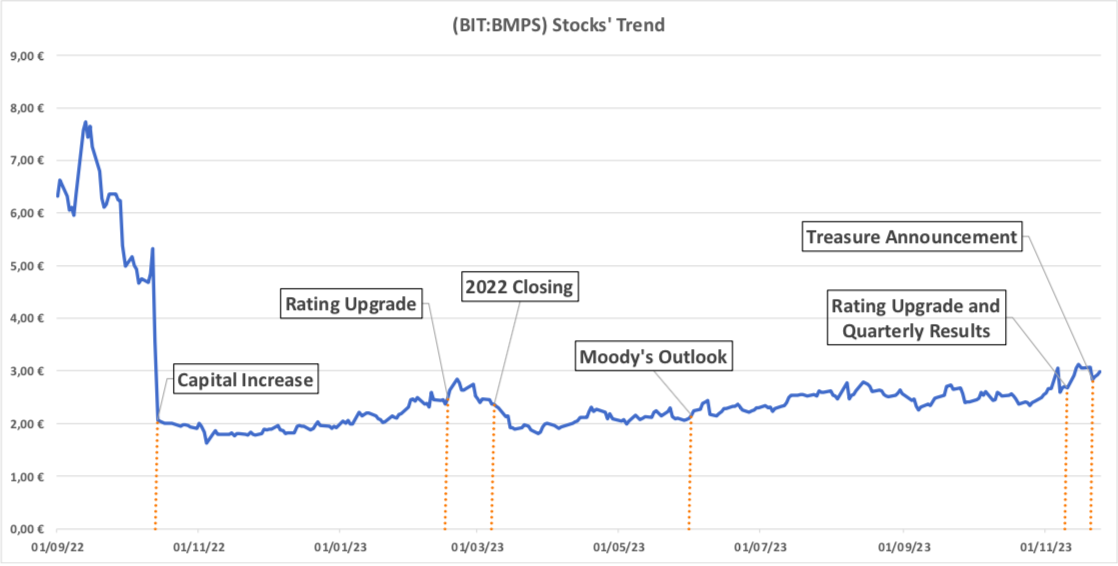

Since the new CEO’s installation occurred in February 2022, it has been a turbulent period for Banca Monte dei Paschi di Siena (BIT:BMPS). Despite the market receiving well Luigi Lovaglio as the new Chief Executive Officer, the stocks’ price has continued falling due to several factors. Firstly, the necessity to do a 2,5 billion euros capital increase has been received badly from the market, because of the capital dilution determined for October 2022 with the underwriting price offered which was discounted by 7,79% from the TERP (Theoretical Ex Right Price). The extraordinary operation result was the 74% stocks’ underwriting, for a countervalue of 1,85 billion euros (about 1,6 billion euros paid in by the Italian Treasury). Secondly, during the closing of the 2022 fiscal year, the report showed a large amount of turnaround costs, such as exoduses costs. In addition, a damage request for 700 million euros saw light. In the same period, the BMPS shareholders’ structure saw AXA’s exit, selling 100 million stocks, failing the 7,91% i.e., its total participation. Owning to the higher supply, on 28 February 2022 the stocks’ price was down by 12%. For the exit, AXA proceeded with accelerated book-building targeting the financial institutions done with a 15% discount from the listed price. In contrast with what has been said, or rather with the market sentiment and the stock trend, under Lovaglio’s governance and thanks to the industrial plan 2022-2026, the bank has improved its position improving revenues, commissions, interest margin, and personal costs. As a result, during 2023, there has been some different raising in the BMPS’s rating. For example, in June 2023, Moody’s enhanced the BMPS’s long-term outlook and the unsecured debt rating, even though the credit losses have increased from 250 million euros in 2021 to 417 million euros in 2022. Of course, the recent outlook and rating upgrades came from the recent new approach and the more consideration of risk management (thanks to appropriate RAF, RAS, risk inventory, and procedures) and the efficiency of the business plan.

Why has the MEF proceeded to sell?

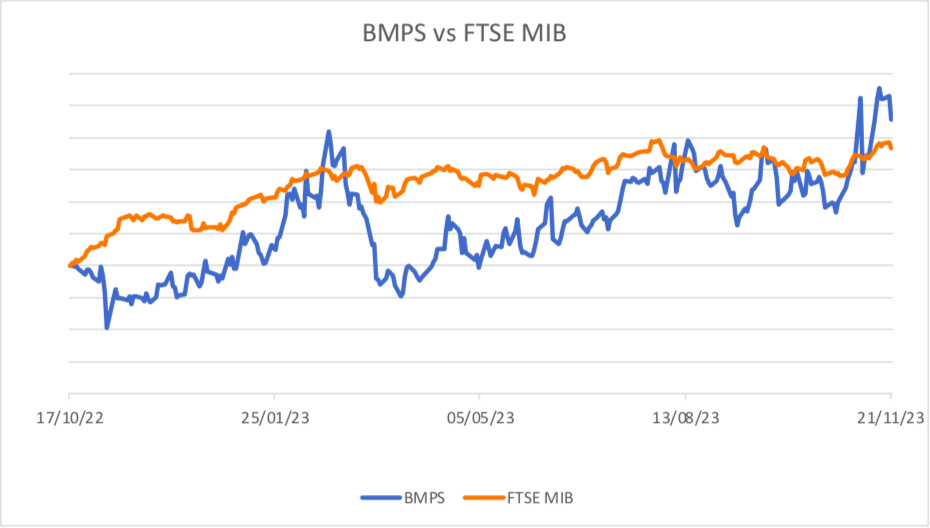

From the time of the capital increase, the stocks have performed very well, with a 48,7% yield in comparison with the 40,6% of the FTSE MIB. Notwithstanding the initial and rational fall of the stock’s price caused by the capital increase, thanks to this one has certainly improved the capital structure of the bank, contributing to the increase in the shares’ price. The time for the BMPS’s privatization may be due to better economic conditions than in the past such as the good performance of both the title (Lovine’s restructuring and higher interest rates allowed BMPS to close the third quarter with a profit of 929 million euros, the publication day shares were up by 18,5%) and the Italian market. Moreover, the European commitment taken from Italy for the consolidation of public finance had a huge weight. In fact, on October 16th Giorgetti, minister of economy and finance, talked about an “ambitious program for privatization” aimed at improving the public balance. So, the government has decided to start with the oldest bank in the world.

The sale

Since last month the Italian Government, in particular the MEF (standing for “Ministero dell’Economia e delle Finanze”) has talked about a flash operation with the selling target of 20% of its participation in BMPS. Moreover, it has chosen Bank of America, UBS, and Jeffries as Joint global coordinators and Joint bookrunners, while Clifford Chance has been chosen as legal adviser. The financial advisories placed the shares using the accelerated book-building method. However, things went better, and the treasury decided to increase the operation selling target to 25%, facing the 5x demand of the initial selling amount. The price has been set to 2,92 euros per share, giving a total inflow amount of 920 million euros. Thanks to this operation, the Treasury’s total exposure has been decreased from 64,23% to 39,23%, spreading 315 million shares. Among the Financial institutions that have bought, it stands out 150 high-profile parties such as Blackrock, Amundi, Norges Bank, Algebris Investment, Mediolanum, Anima Holding, Kairos, Fideuram and Eurizon. It seems that none of the 150 entities has bought shareholdings packs up to 3%.

Conclusion

For the reasons discussed in the second paragraph, it could be that, sooner or later, it will be the turn for other crown jewels, such as Leonardo, ENAV, and ENI beyond the more probably privatizations of Poste Italiane and Ferrovie dello Stato. While looking at Banca Monte dei Paschi, during November the CEO bought 34.000 shares with an average price of 2,9. Usually, insider operations are looked at as a signal of trust. In addition, the remaining shares will be collocated during 2024, if the Italian Government respects the commitment of the BMPS’s total privatization taken with Europe. Furthermore, the MEF is carrying out a partnership for the placement. Nowadays, the most quoted partners are UniCredit, BPER, and Banco BPM, the last one may be the counterpart for a merger.